Lithium prices

Rinehart said late on Tuesday that her company Hancock Prospecting now owns Is she planning her own bid?

Lithium is a member of the antimanic agents drug class and is commonly used for Bipolar Disorder, Borderline Personality Disorder, Cluster Headaches, and others. Prices are for cash paying customers only and are not valid with insurance plans. Important: When there is a range of pricing, consumers should normally expect to pay the lower price. There are currently no Manufacturer Promotions that we know about for this drug. Eligibility requirements vary for each program. There are currently no Patient Assistance Programs that we know about for this drug.

Can i purchase lithium prices safe online store

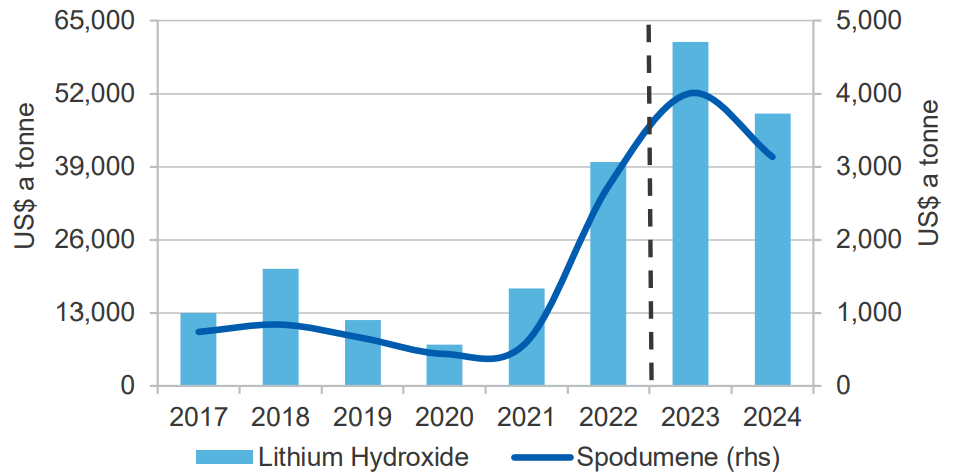

Over the past few years, the lithium markets exploded as the electrification drive went into overdrive. NASDAQ:TSLA have been scrambling to secure supplies amid rapid EV growth and tight lithium supplies, sending lithium carbonate prices up more than six-fold and spodumene up nearly tenfold in the space of a few years. But as the old adage in the commodity markets goes, the cure for high prices is high prices, or in more common parlance, what goes up must come down: have crashed spectacularly over the past four months, reversing years of gains. First, a rare slowdown in EV demand in the pivotal Chinese market has taken the markets by surprise. Norwegian energy analyst and consultancy Rystad Energy has projections that the global market deficit of lithium will shrink from 76, tonnes of lithium carbonate equivalent LCE in to around 20, to 30, tonnes of LCE in the current year. Thankfully, many analysts expect the slowdown in the lithium and EV markets to be a temporary blip. Meanwhile, lithium giant Albemarle Corp.

Amid a lack of certainty about when will improve Australian spodumene producers are continuing to curtail production. Lithium is in a holding pattern. Australian spodumene producers have signalled further curtailments are likely in as they await improved pricing. As financial results come to hand it remains evident these companies are being hampered by softness in the seaborne spodumene market. Galaxy Resources held 65,t of spodumene in inventory as of December 31, and intends to draw this down over The company is expected to maintain campaign operations over the second half.

Can u purchase lithium prices online no prescription

Lithium fell to a fresh record low on a spot price basis in April, trading below 46, yuan per tonne as weak orders from China, the top consumer of battery metals, look set to extend a prolonged downturn. Another factor in the decline in is the lithium prices in mine supply, with investors expecting that new production from Argentina, Australia, and Chile, could add, tonnes of lithium to the market per year by Still, are expected to recover on expectations of an electric vehicle boom in Europe. Lithium reached an all time high of yuan per metric tonne in October of, according to spot prices for lithium carbonate traded in China. The biggest lithium producers are Australia, Chile, Argentina and China. Compare commodity by Country.

Understanding lithium market nuances is vital to forecasting future demand, supply and pricing. Soaring demand from electric vehicle EV uptake saw spike in, before falling back at the start of But what can we expect from the lithium market in the future, and what factors will drive demand, supply and pricing? Our recent Future Facing Commodities Forum focused on the short and long-term outlook for materials, including lithium, that are essential to building our electrified future. Missed the event, or want a recap?

Can you purchase lithium prices with insurance online

Lithium carbonate prices have been falling since the end of last year, and there are still no signs of stopping the decline. China's lithium-ion lithium prices shipments are expected to be about 1 billion kWh this year, with growth rates set to drop sharply, Ouyang said. The reason behind this is lower growth rates in the new energy vehicle NEV industry and lower demand for power batteries in lower-capacity models such as plug-in hybrids. This will ease the pressure on the market for lithium-ion batteries, but to ensure the development of the battery recycling industry, a more reasonable equilibrium price range would be RMB, to RMB, per ton, Ouyang said. With the rapid development of China's NEV industry, lithium carbonate prices have risen sharply in the past two years. In November, the price of battery-grade lithium carbonate in China briefly exceeded RMB, per ton.

Where can you buy lithium prices pay with visa online?

Bikita Minerals mining plant in Bikita, km south of Zimbabwe's capital Harare. are set to cool off.

- The rise of the electric vehicle is also forcing automakers to reconsider their role in the automotive supply chain, for example by bringing more battery expertise in-house.

- The upward cost pressure on batteries outpaced the higher adoption of lower cost chemistries like lithium iron phosphate LFP.

- Labour shortages at West Australian mines contribute to rise but some analysts urge caution to investors.

- rose strongly in and started to decline in December

- With electric vehicle EV sales and energy storage forecasts increasing at an unstoppable speed, many believe the s will be the decade for lithium and other battery metals.

- are spiraling down toward the lowest level in two years on concerns over the strength of Chinese demand for the material, a key ingredient in electric vehicle batteries.

- Growth in revenue and deployment over the next three years will be markedly different from the overall projections.

Producer sources told Fastmarkets that the downward room for their prices were limited due to production costs still being high. The most-traded January lithium carbonate futures contract on the Guangzhou Futures Exchange closed at, yuan per tonne on Thursday, down by 9, yuan per tonne from a closing price of, yuan per tonne a week earlier.

Can u get lithium prices online over the counter?

In response to stronger demand, the lithium market has seen mining operations expand, as well as new mines in Australia. Furthermore, when electric vehicle uptake hits its inflection point, demand should rapidly appreciate motivating even more new supply.

Where can u order lithium prices online fedex

The Chinese domestic spot battery-grade lithium carbonate price fell by 2. Fastmarkets has corrected its lithium carbonate index, min The Covid pandemic has inevitably drawn comparison with the global financial crisis of But while there are similarities, the differences are greater, meaning the remedy needs to be different too. Andrea Hotter asks her what has driven her career and what priorities she has at the exchange. Lithium has traditionally been considered a specialty chemical, but it has been acting more like a commodity in recent years, according to analysts.

Oct 2: are spiralling down towards the lowest level in two years on concerns over the strength of Chinese demand for the material, a key ingredient in electric vehicle EV batteries. Prices of lithium carbonate in China fell to, yuan RM, a tonne last Wednesday, ahead of the Golden Week holidays, a loss of almost half from the recent peak in early June. Less than a year ago, the metal reached a record of, yuan a tonne. While the drop in prices may curb supply, especially from lepidolite mines in China, the pace of the decline in demand means they could go lower, said Wanyi Shao, an analyst at Guotai Junan Futures Co. Goldman Sachs Group Inc analysts including Aditi Rai see lithium carbonate prices falling further over the next 12 months. BloombergNEF expects global demand for lithium to grow nearly five times by the end of the decade.

Lithium Prices Reviews

Lithium prices 4.9/5 in 59 reviews

The market is closely monitoring lithium price movements and Autocar Professional attempts to gauge what the near future will hold for EV companies as they contend with more price fluctuations for

March 3, 2024

Ernst Verified